This article was originally published by Tyler Durden at ZeroHedge.

While the latest IMF forecasts were mostly lost in the din surrounding the start of earnings season, besides the now standard cuts to global growth forecasts, there was one standout item.

As the National Bank of Canada points out, the IMF’s projections forecast US net debt to rise from 95% of GDP in 2023 to 110% by 2028, which actually is a conservative estimate when comparing a similar, if even more concerning longer-term forecast from the Congressional Budget Office, which effectively projects hyperinflation.

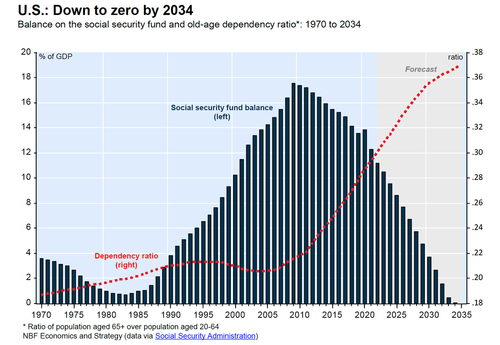

But while the fate of US debt/GDP in 2050 may feel like someone else’s problem to most Americans, NBC warns that a far more pressing issue may emerge as soon as a decade from today. That’s because unless Washington raises taxes more or slashes benefits (an unlikely outcome), the Social Security fund will hit net zero – i.e., will be exhausted – in just 10 years.

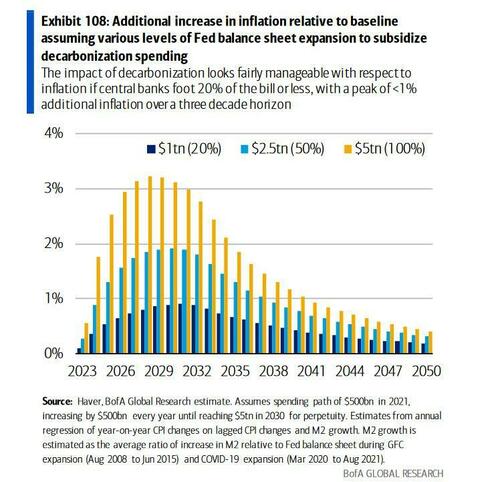

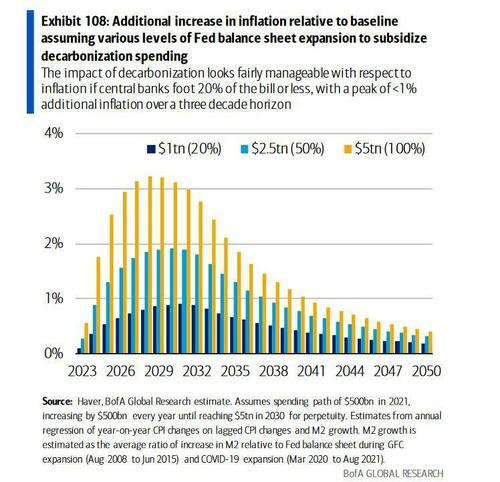

And as US social security becomes a pay-as-you-go system, sovereign debt issuance will increase at an accelerated rate to offset the statutory decline in the social security fund balance. That, combined with the global “Net Zero” cost forecast of $150 trillion over the next 30 years – or some $5 trillion per year – most if not all of it courtesy of the Federal Reserve…

… means that in the very near future, the Fed will be drawn back in to monetize debt (read restart QE) at a pace that has never been seen before. The only question is which crisis will get us there first.