This article was originally published by Thorsten Polleit at The Mises Institute.

Relief is spreading among economic analysts and stock market experts. Energy prices are decreasing noticeably. The energy supply this winter seems secure; in Europe, government support for consumers and producers is available if needed.

China is turning away from its zero-covid policy, and production is ramping up again. High goods price inflation is still a major concern for consumers and producers, but central banks are delivering at least some interest rate hikes to hopefully reduce currency devaluation. So should we bid farewell to crisis and recession worries? Unfortunately, no.

Because there is an overall economic development that is tantamount to a storm but remains unnamed by many experts and investors. And that is the global contraction of the real money supply. What does that mean? The real money supply represents the actual purchasing power of money. For example, You have ten dollars, and one apple costs one dollar. So with your ten dollars, you can buy ten apples. If the apple price increases to, say, two dollars per piece, the purchasing power of the ten dollars falls to five apples. It becomes obvious that the real money supply is determined by the interplay between the nominal money supply and the prices of goods.

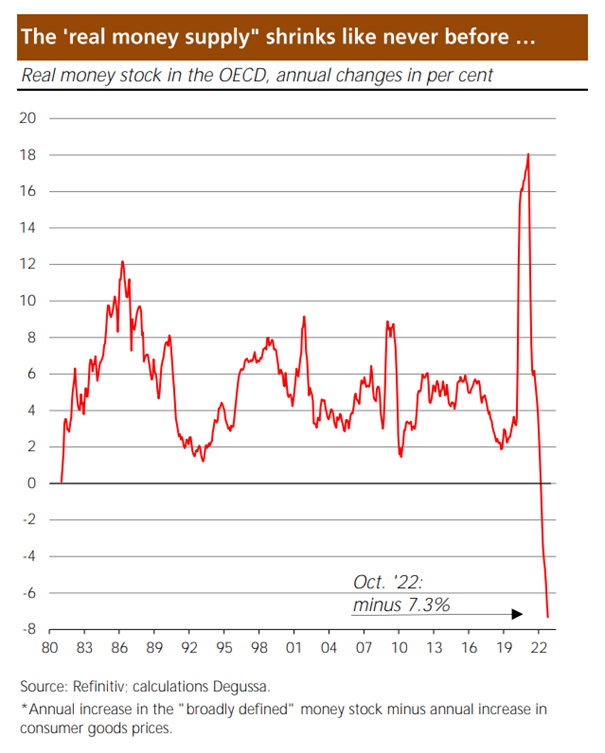

The real money supply in an economy can decrease when the nominal money supply goes down or goods prices rise. This is exactly what is currently happening around the world. The chart below shows the annual growth rate of the real money supply in the Organization for Economic Cooperation and Development (OECD) from 1981 to October 2022. The real money supply recently contracted by 7.3 percent year on year. There has never been anything like this before. What is the reason?

The enormous rise in goods prices, i.e., the high inflation, is a consequence of central banks’ monetary policy. In the course of the politically dictated lockdowns, central banks have increased the money supply enormously. For example, the US Federal Reserve has expanded the M2 money stock by around 40 percent since the end of 2019, and the European Central Bank has increased the M3 money supply by 25 percent. As the growth in the supply of goods has not kept pace, a huge money supply overhang has emerged, which is now met with cost-push effects—such as the consequences of green policies, lockdowns, and the Ukraine war—unleashed in sky-high goods price inflation.

In the meantime, however, nominal money supply growth has fallen sharply again. In the US, it fell by 1.3 percent year on year in December 2022 and to 4.1 percent in the euro area. The reason: loan demand is declining, commercial banks are granting fewer loans, and consequently, the new money supply generated by bank lending is falling. Furthermore, central banks are no longer buying government bonds, which is one reason why the inflow of new money into the economy is drying up.

It may sound paradoxical, but in economic terms, the current high goods price inflation is reducing the money supply overhang, and along with now significantly reduced money supply growth, downward pressure on future inflation is already increasing.

However, if the real money supply continues to shrink as sharply as it is currently, the signs point to at least an economic slowdown and, more likely, a recession. When the real money supply in the economy shrinks, those holding cash become poorer. They can now no longer purchase the quantities of goods they previously bought and need to adjust their spending: stop buying more expensive goods or continue buying more expensive goods while forgoing other things. The result is a drop in aggregate demand.

This phenomenon is, by the way, well known in theory as the “real balance effect.” It goes back to the Israeli-American economist Don Patinkin (1922–95). Patinkin wanted to show, among other things, that the national economy can, so to speak, heal itself in crises without the need for government intervention. If, for example, goods prices fall in a recessionary depression, this strengthens the purchasing power of market players if and when the money supply remains unchanged. They can expand their demand for goods, and the economy works its way out of the crisis more or less automatically.

Applied to current conditions, we can see that a rather powerful negative money balance effect is unfolding: The initial increase in the quantity of money results in a rise of the real money supply, which fuels consumption and production. Then, goods price inflation takes off, and, at the same time, monetary expansion slows down. The result is a very sharp decline in the real money stock, which, in turn, leads to lower economic activity, even recession.

The contraction of output and employment, in turn, exerts downward pressure on rising goods prices, establishing a new relationship between the outstanding money stock and goods prices in accordance with peoples’ preferences. Once this adjustment has run its course and the nominal money stock remains unchanged, goods price inflation dies out. The economy ends up with a higher level of goods prices when compared with the situation before the nominal money supply had been increased.

So why do central banks want to raise interest rates even further? Monetary authorities fear that doing nothing and waiting in the current regime of sky-high inflation could erode people’s trust in unbacked paper currencies. That, in turn, would push up market participants’ inflation expectations—which, incidentally, is already happening—and create an even bigger inflation crisis further down the road. Moreover, central bank councils usually base their monetary policy on current inflation; they typically have little or no regard for the development of the real money supply.

The central banks thus—consciously or unconsciously—trigger a stabilization recession, an economic contraction to break the inflationary wave. At first glance, their plan could most likely work out. Because if the demand for goods drops, companies can only reduce their inventories by cutting prices. The leeway for passing on costs and speculation on future price increases diminishes. Higher wage demands fail to materialize. And most importantly, credit and money supply growth ebb away in a recession, mitigating future inflationary pressure. But at second glance, this is a very explosive approach in the current monetary environment.

A recession will likely put highly indebted economies under severe stress. Many debtors will no longer be able to service their debts. Loan defaults increase. As a result, banks become reluctant to grant new loans and demand repayment of expiring loans. Investor confidence in debt-ridden economies and financial markets is dwindling. The result would be a fulminant credit crisis, at least at the scale of the one in 2008/9. Investors fear that their interest and principal payments will not be made. Credit markets freeze and the unbacked monetary system is headed for collapse.

The economic pain would be enormous, and the political pressure on central banks to lower interest rates again and keep the economy afloat with new credit and more money would be foreseeable. In the hour of need, governments and the public at large will likely see the policy of the least evil in increasing the money supply. Even a sky-high inflation policy becomes acceptable from their point of view to escape a perceived even greater evil. There are quite a few examples of this tragic handling of the unbacked paper money system.

Just think of 2008/9 (the global financial and economic crisis) and 2020/21 (the crisis after the politically dictated lockdowns). To ward off the crises or keep them as small as possible, central banks lowered interest rates and drastically expanded the money supply. The outcome was inflation—asset price inflation from early 2009 or consumer goods price inflation, which reared its ugly head toward the end of 2021. From this perspective, it is not unlikely that history will repeat itself.

If central banks are not stopped from doing what they are doing—causing booms and busts by manipulating market interest rates downward and relentlessly expanding the quantity of money created out of thin air—their actions will eventually lead to a level of inflation well beyond what we have witnessed over the past year and a half. From this perspective, the sharply contracting real money stock in the world economy is—it has to be feared—the harbinger of a new round of super-easy monetary policy and super-high inflation, even hyperinflation, further down the road.