This article was originally published by Tyler Durden at ZeroHedge.

With oil slumping into a deep bear market, tumbling (briefly) below $100 yesterday and just shy of where it traded before the Ukraine war, the Biden administration is preemptively declaring victory: after all, between sliding oil prices, refineries finally working in lockstep and spreads collapsing, it’s no surprise we have seen gasoline prices drop for the past 22 days, the longest stretch since the covid depression.

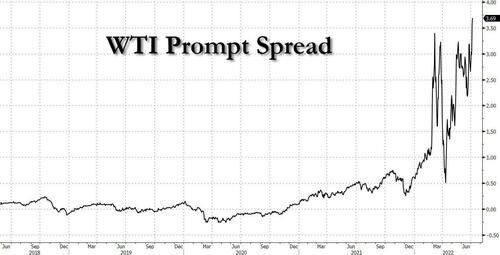

Sadly for Biden, this steep drop in both oil and gasoline prices is unlikely to stick, and not just because the fund liquidation that sent oil so sharply lower is in wild contrast with the wildly bullish dynamics in the physical market where the prompt WTI spread surged higher on Wednesday, climbing by the most in four months and hitting the highest in recent history.

Nor because if reports of a $220BN Chinese stimulus are true, it means that Beijing is about to order every barrel of oil it can find. The real reason why oil may be about to spike sharply higher comes out of Texas where an imminent power shock may lead to widespread oil infrastructure shutdowns.

Here is what a dealer for one of the larger institutional crude and products books writes:

… looking like Texas may be short power for the next week or so. Wild rumors floating around that the Governor may call on industrials (ie refineries) to idle or significantly de-rate plants for up to a week to keep from having to black out residential consumers (Mom&Pop) in a heat wave. Don’t want to make folks sweat at home in the dark during an election year.

Key takeaway? Cracks may just be getting started and could go parabolic here.

And if cracks soar, underlying prices won’t be far behind. And yes, gasoline prices are about to reverse all recent losses with a vengeance. As for oil, well the reversal is already starting.