We’ve reported on the China property and solvency crisis over the past few weeks. The Evergrande solvency issues started it but now the whole property sector appears to be in a free fall.

We’ve been reporting on the Evergrande real estate and solvency crisis in China for weeks. It’s not good.

In addition, we’ve been reporting for the last few years on the dangers embedded in China’s huge property market which are now more apparent than ever:

BREAKING EXCLUSIVE: China’s Economic Crisis Has Arrived – This Will Impact the Entire World

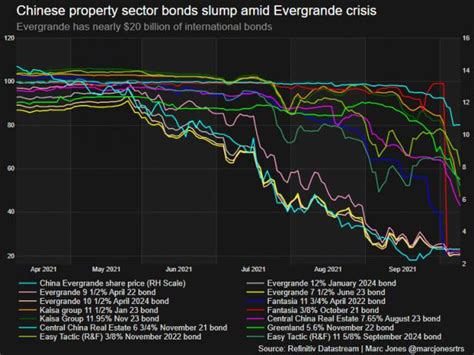

This evening George Gammon shared a chart of the Chinese property sector bonds since the Evergrande crisis began:

Chinese bonds getting smoked. This is going to be far bigger than Evergrande.

Question is will it be far bigger than China?

China recession/depression has massive knock on effects. pic.twitter.com/7gAQIHuI9R

— George Gammon (@GeorgeGammon) October 12, 2021

This is not good. This is not good at all.

The post DEVELOPING: China’s Property Sector Bonds Are ‘Getting Smoked’ – Will China’s Economic Woes Impact the Rest of the World? appeared first on The Gateway Pundit.

Chinese bonds getting smoked. This is going to be far bigger than Evergrande.

Chinese bonds getting smoked. This is going to be far bigger than Evergrande.