The FTX scandal is only getting started. Another cryptocurrency by the name of Tether is also on the brink of failing and both FTX and Tether appear to have been tools of the Deep State.

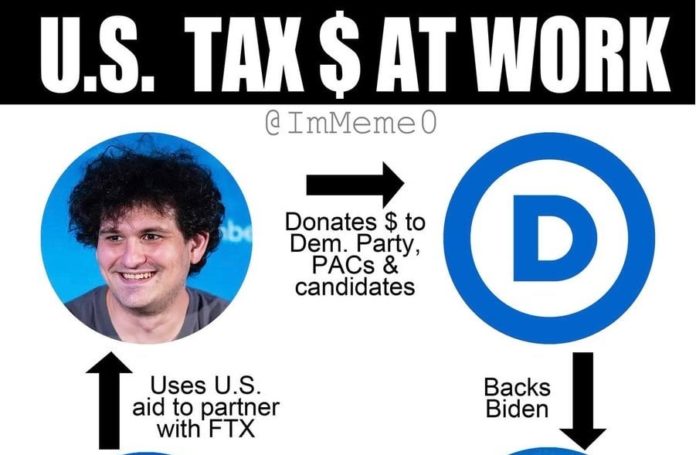

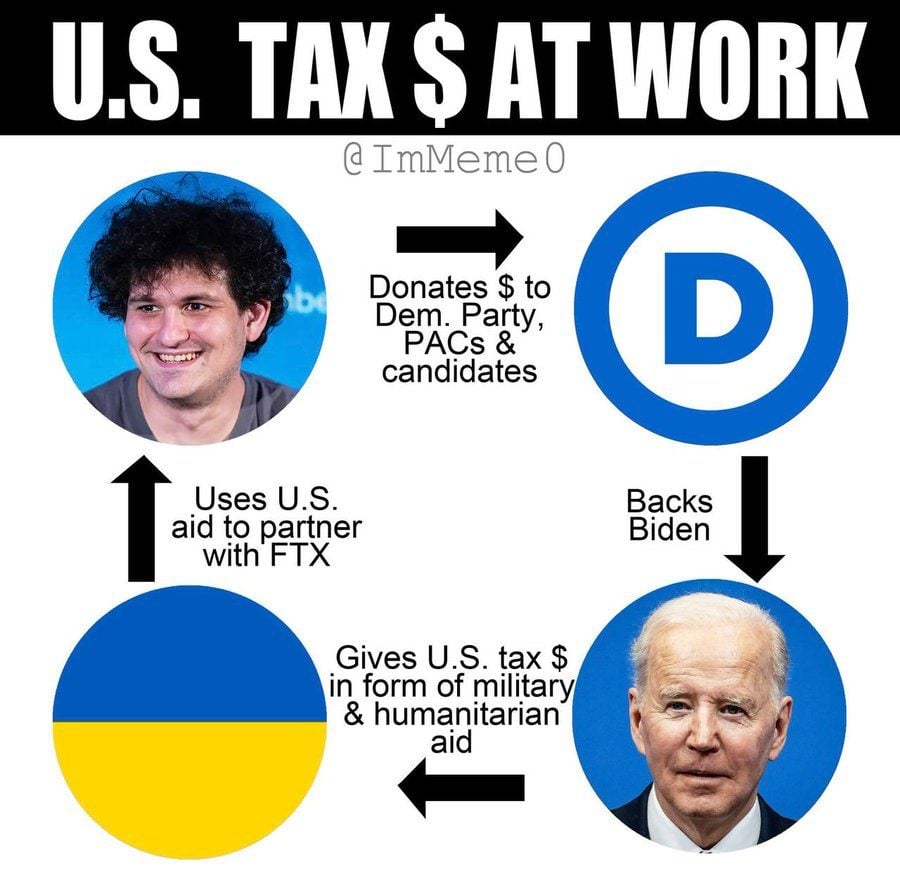

A week ago TGP reported that FTX was used as a money laundering scheme in Ukraine where money sent there was sent back to US politicians.

Revolver added more to this story overnight. In a lengthy article, Revolver notes first that FTX may not be the largest cryptocurrency-related entity to collapse in the coming months. Another crypto by the name of “Tether” or USDT is also in big trouble.

USDT, or Tether, is what is known as a “stablecoin.” A stablecoin is a cryptocurrency that, instead of fluctuating in value, is intended to hold to a consistent price. Tether is a USD stablecoin — each Tether is supposed to be equal in value to one U.S. dollar. While most cryptocurrencies are wildly speculative and backed by essentially nothing, each Tether is supposed to be backed directly by a U.S. dollar, or an extremely liquid, reliable investment like a U.S. treasury bond….

…Tether has the third highest market cap of any crypto currency at $66 billion, trailing only Bitcoin and Ethereum. Today, fully half of all bitcoin trades globally are executed using Tether.

Revolver goes on to report that Alameda Research was one of two firms responsible for “seeping” Tether into the crypto ecosystem.

Did that last sentence set off any alarm bells? It should have. Alameda Research is the quantitative trading firm founded by Sam Bankman-Fried. Bankman-Fried and his partner in crime, Alameda CEO Caroline Ellison, allegedly propped up their trading firm by plundering FTX customer accounts.

The inner workings of Tether remain remarkably opaque. New Tethers are supposed to only be minted, and added to the crypto ecosystem, when somebody gives Tether Limited dollars to create them. And if that’s how it all worked, Tether would be fine.

But there is no evidence Tether actually works this way. We repeat: There is no proof that Tether stablecoins are backed by the store of tangible assets that is supposed to justify their value.

Surprisingly, Tether has never been audited. No one knows if Tether which has a $68 billion market value is really backed by the dollar.

The “Wolf of Wall Street” even has questions about Tether.

Revolver sums it up like this:

It’s important to state what is happening if Tether is not actually backed by the dollars that it claims. If Tether Limited is pumping out new Tethers without actually taking in an equal amount of USD, then it is essentially a privately-run money printer.

Revolver then goes on to discuss the founder of Tether, “a washed-up former child actor involved in a sex scandal with underaged minors that quietly dissipated without charges.”

Ultimately, it is clear that Tether is a mess, a real big mess.

But the strange thing about it is that US government-backed rebels in Myanmar are using Tether as their currency of choice. It also happens that al-Qaeda-affiliated Sunni rebel groups of Syria also just so happen to love Tether.

Tether is not just the cryptocurrency of choice for US-backed rebel groups. It has also become a favorite of drug cartels, which, according to some journalists, are deeply intertwined with U.S. three-letter agencies, including the CIA.

When the U.S. placed sanctions on Tornado Cash, a crypto service that assists in concealing the transfer of crypto funds, Tether ignored that sanction. One might expect that defiance to draw the wrath of U.S. regulators. Yet when the Washington Post looked into the matter, regulators seemed surprisingly unbothered.

And of course, Tether is being used in Ukraine –

Tether demand skyrocketed in Ukraine right after the Russian military operation began in February of this year. Ukrainian charities made appeals for Tether-based donations.

All of this was aided by Tether’s special advantage for use in money laundering, according to Bloomberg:

Revolver goes on to describe the close relationship between Tether and FTX. What really is going on?