More terrible news for the Biden economy. Big Banks and Big Tech companies are beginning to lay people off.

According to recent reports, the layoffs are beginning. Now with inflation at record highs on gas prices, food, and energy, Americans are losing their jobs.

The Conservative Treehouse mentioned a report by Reuters yesterday that notes this unfortunate trend for college grads:

In what appears to be a counter trend to the Great Resignation of 2022, when legions quit for new jobs, some tech job-seekers now face cost cuts and hiring freezes amid four-decade-high inflation, a war raging in Ukraine and the ongoing pandemic.

In the case of those who were poised to join Twitter, the whims of billionaire Elon Musk have also caused stress. Musk has agreed to buy Twitter for $44 billion, but his recent tweets have raised questions about when and if the acquisition will be completed.

To be sure, hiring in the tech sector as a whole has remained strong, according to experts from staffing and consulting firms. Tech roles in the healthcare and finance industries are strong, as well as in the information technology field, said Thomas Vick, a Texas-based regional director for staffing firm Robert Half’s tech practice.

But for the incoming class of new hires out of college, losing their job offers now is especially damaging as they said they are locked out of companies like Meta Platforms, Alphabet Inc’s (GOOGL.O) Google and other tech giants, which have already secured their new cohort of recruits. (read more)

In addition, Big Bank JP Morgan Chace recently cut or moved around a thousand mortgage-related jobs.

There are going to be multiple negative economic indicators surfacing in the next 60 days as the first wave signals of a deep and prolonged recession begin to reach shore. Think of it like an economic meteor that hit the mid-Atlantic while only a few people were tracking its inbound trajectory and prepared for what was likely.

We are not likely to see much good economic news, but on the positive side, most readers are prepared. Again, I will repeat… If you did not purchase a home this year, you are already ahead financially.

Housing sales are dropping fast, but housing values are, on a regional basis, holding steady – for now. However, the banks and lending institutions are preparing for those values, and the contained equity, to drop and disappear precipitously.

Today Bloomberg is reporting that JPMorgan Chase is shifting around 1,000 employees in the mortgage side of finance with some being laid-off and others being reassigned to different parts of the bank and financial services. This should not come as a surprise, but it does align with other less noticeable moves in the banking and home loan sector.

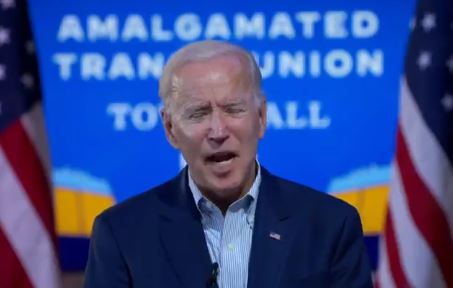

What Biden says means nothing now. You have to look at the data and accurate sources.