This article was originally published by Tyler Durden at ZeroHedge.

In the latest bizarre move by western nations meant to hurt Russia, but will blow back and help Putin get even richer while impoverishing western motorists with even higher gas prices, G7 leaders meeting at a Bavarian Alp summit, plan to impose a “price cap” on Russian oil as the group works to curb Moscow’s ability to finance its war in Ukraine, the FT reported.

The latest sanction follows news that the same G7 will also impose an import ban on Russian gold, which western nations already can’t buy, and which will only push even more physical gold into the willing hands of India and China while pushing global prices higher.

Talks were set to continue on Monday, having begun on Sunday in the luxury resort of Schloss Elmau, where leaders want to enlist a range of countries beyond the G7 to put a ceiling on the price paid for Russian oil.

It isn’t exactly clear just what such a cap would achieve since western nations have already “agreed” to ban Russian oil imports sometime in 2023 (or maybe that was 2024… or 2025), but according to the FT, leaders hope a cap will limit the benefits of the soaring price of crude to the Kremlin. Of course, that won’t work since non-G7 member states will pay Moscow anything it wants to be paid, and as such, the price cap will only demonstrate to the world just how meaningless G7 “unity” is in a world where the two largest nations – India and China – side with Russia.

The idea of an oil price cap comes as the high price of crude means Russia’s revenues from oil exports have surged and declined despite western restrictions on Russian oil imports. The concern is also mounting that attempts to ban ships carrying Russian oil from accessing western insurance markets this year could drive global oil prices to unprecedented levels. The International Energy Agency warns it could contribute to the shutdown of more than a quarter of Russia’s pre-invasion production.

Under the price-capping scheme, Europe would limit the availability of shipping and insurance services that enable the worldwide transport of Russian oil, mandating that the services would only be available if the price ceiling was observed by the importer. A similar restriction on the availability of US financial services could give the scheme added impact.

Obviously, this naive proposal has had the full backing of the Biden admin and recent comments by German officials suggested Berlin was also coming around to the idea. Officials said that Mario Draghi, Italy’s prime minister, told fellow G7 leaders that energy price caps were needed because “we must reduce the amount of money going to Russia and get rid of one of the main causes of inflation”.

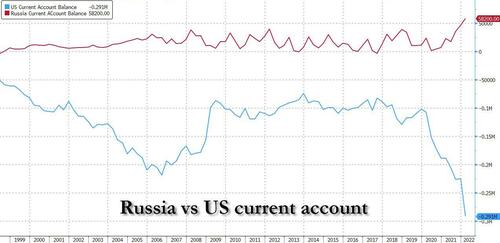

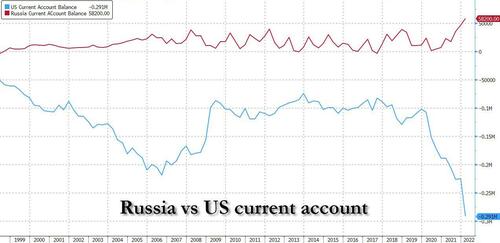

While it is understandable that Europe is angry that its actions have helped Russia claim a record current account surplus, even as the US current account deficit hits an all-time high…

… it is not at all understandable how a self-imposed “price cap” by European nations – who have already made buying of Russian oil effectively illegal – and which needs to be implemented by all nations in the world and won’t be with China and India holding out, will achieve anything.

In any case, the FT reports that on Monday, the caps will be debated by a broader group when the leaders of Germany, the US, UK, France, Italy, Japan and Canada are joined by “partner” countries invited to the summit. These include India, which has become a big buyer of discounted Russian oil since the invasion of Ukraine, as well as Argentina, South Africa, Senegal and Indonesia.

Charles Michel, president of the European Council, said the EU was ready to decide with its partners on a price cap but stressed the need for a “clear vision” and awareness of possible knock-on effects. “We want to make sure the goal is to target Russia and not to make our life more difficult and more complex.”

A senior German official told the FT that “intensive discussions” were under way on how a cap would be implemented and work alongside western and Japanese sanctions. “The issues we have to solve are not trivial, but we’re on the right track towards coming to an agreement,” the official added.

Where it gets confusing is that the EU in May agreed to a phased-in ban on seaborne Russian oil shipments while temporarily allowing crude deliveries via pipeline to continue. The US has already banned Russian oil imports and the UK plans to phase them out by the end of this year. So in effect the US has banned Russian oil, and its push for “price caps” is just to warn those nations which are still overly reliant on Russian to not overpay! One couldn’t make this up!

Meanwhile, unfazed by the Bavarian clown show, Russia could cut oil supplies sharply in response to any attempt to impose a price cap energy executives warned, or make further cuts to gas exports to Europe.

So let’s get this straight: Europe threatens to cut imports from Russia further, and pretend to pay less, but only if Russia doesn’t cut exports to Europe even more first.

Realizing perhaps that the facade of Europe’s “united front” has become a very expensive joke to most European populations, UK prime minister Boris Johnson reiterated the need to maintain consensus, warning of “fatigue” among “populations and politicians”. And just to make sure there is even more fatigue, in “a mark of solidarity”, Ukraine’s comedian-actor president Volodymyr Zelenskyy was invited to join the G7 summit by video link on Monday.

As part of efforts to raise the economic pressure on Russia, Britain, Canada, Japan and the US announced moves to ban imports of Russian gold. “We need to starve the Putin regime of its funding,” said Johnson, clearly unaware that anything the West doesn’t buy, Asia will buy twice as much of at a 25% discount.

As for why this price cap idiocy is Dead on Arrival Germany’s Scholz stressed that the concept will need widespread buy-in around the world… which it will never get! It would also require the EU to amend its ban on insuring Russian crude shipments — introduced with the ban on seaborne oil imports — which would need the buy-in of all 27 member states, which is also unlikely to happen with Hungary the perpetual hold out.