Donald Trump Jr. to Newsmax TV: Dems ‘Insurrected’ Us

Rep. Devin Nunes to Newsmax TV: McConnell’s Vote Critical to His Political Future

CZ Introduces New Synthetic Stock Rimfire Rifles for 2021

The post CZ Introduces New Synthetic Stock Rimfire Rifles for 2021 appeared first on The Firearm Blog.

Marine Corps Prioritizes Synthetic Training Systems

The post Marine Corps Prioritizes Synthetic Training Systems appeared first on The Firearm Blog.

Wheelgun Wednesday: A Look At The Tranter

The post Wheelgun Wednesday: A Look At The Tranter appeared first on The Firearm Blog.

POTD: The TE-Titan Suppressors

The post POTD: The TE-Titan Suppressors appeared first on The Firearm Blog.

Short Barrel Soft Point Showdown: Hornady Black HD SBR Review

The post Short Barrel Soft Point Showdown: Hornady Black HD SBR Review appeared first on The Firearm Blog.

Surviving an Economic Collapse

Everyone longs for financial stability in their life; however, despite your best efforts, circumstances outside your control might cause the value of your assets to hit rock bottom in a matter of days, if not hours. What if such a catastrophe affected hundreds of thousands, millions, or tens of millions of people all at once? Could there be a foreseeable future where money has no value, and all that financial strategizing and planning you’d spent years on was in vain? Elections, economic sanctions, inflation, recessions, the stock market, and just plain old fear are just some of the elements that can contribute to the fluctuating value of money. Sometimes a perfect storm of those factors causes economic turmoil for months or years, as we saw in the Great Depression of the 1930s or the Great Recession of the late 2000s.

If a catastrophe caused the dollar to plummet in value, would something else become the de facto currency? After all, the true value of anything is whatever someone’s willing to pay for it. Would people trade in cryptocurrency, jewels, or precious metals until stability is restored and paper currency regains value? Or would the collateral damage of the financial world cause durable goods such as tools, guns, or survival gear to become modes of exchange, since everyone needs them? We asked a few experts how cash alternatives could come into play during a financial crisis and what form they may take.

Specifically, we picked the brains of financial consultant Sandip Sehmi, economist Dr. Chris Thornberg, economics professor Dr. Raymond Sfeir, and precious metal expert and cryptocurrency investor Chris Kahrhoff to weigh in with their thoughts. While their responses vary, they provide a baseline of recommendations to plan for such a catastrophe. Like every other aspect of survival, having an understanding of options is key to adapting to challenging circumstances.

Alternate Currencies

RECOIL OFFGRID: What are some possible alternative forms of currency if there’s a situation where cash has no value?

Chris Kahrhoff: U.S. coins were made out of precious metal up until 1964. These are coins that are 90-percent silver, so dimes and quarters because their face value represented exactly what their silver content was. So a silver quarter from that period said 25 cents, but today it’s worth about $4.50. Because it’s illegal to melt down U.S. currency, those are traded in bags where the face value will say $1,000, shorthand for saying 1,000 ounces that’s worth about $19,000. Of course these prices constantly fluctuate, so by the time your readers see this 1,000 ounces might be worth more or less than that. That kind of “junk silver,” as it’s called, I could see being traded. It’s still theoretically a quarter, but it’s ¼ ounce of silver.

These coins are very easy to find. There’s a website called APMEX, a large precious metal dealer based out of Oklahoma where you can buy junk silver in different denominations. The problem with 1-ounce silver coins is that today it’s worth whatever it’s trading for, but no one’s going to fractionalize that. That’s why I think the junk silver works for buying milk, bread, gas, or something like that. Maybe for larger purposes, a 1-ounce coin or 10-ounce ingot of silver would be used.

Money is just shorthand and a means of exchange. Someone will always want to figure out that shorthand rather than figure out whether they need 500 rounds of SS109 or 6 gallons of gas and which to trade for. People would rather use something more fungible, meaning it’s the same no matter whom you trade it to. The fungibility of silver or gold is a faster process. People will want ammo, food, and gasoline, but I still think bringing those connections together is much harder than it is to say, “I’ve got a silver coin I can exchange, and you can decide what you want to do with that coin.”

With cryptocurrency, there’s a huge amount of anonymity — some cryptocurrencies more than others. If the government wants a cashless society, crypto represents sort of a middle finger to that thought process. It removes itself from that control. Crypto does work in a grid-down type of situation. You can do cryptocurrency transactions over a mesh network. People have sent Bitcoin over HAM radio. I don’t know the particulars of that, but they’ve accommodated these transactions outside the normal internet. It’s still viable as a transaction. Does it take longer? Yes. If you want to move large or small sums of money you can divide that Bitcoin into one-hundred-millionth of a Bitcoin, so whatever kind of micro-payments you want to make, you can do. Recently someone moved $1 billion in Bitcoin from one address to another; it cost them $700, and it happened in 10 minutes. You can’t do that with real cash or gold. With the weight, logistics, and security involved, it’s substantially more difficult.

Sandip Sehmi: I was recently in the Ukraine and Italy where there are serious concerns about the economy. There is a lot of talk about “black money,” which is cash income that is not reported for taxes. They use this money for daily expenses like groceries, gas, and restaurants instead of credit cards because The government is going above and beyond to track incomes. They even started looking at credit card statements to see what people are spending to see if it coincides with their reported income. They’re doing these deep dives into people’s finances and then arbitrarily assessing them with taxes.

There’s also the question of what causes a financial disaster and how that factors into what’s valuable. Look at it this way, don’t you feel more confident with a couple hundred bucks in your pocket than a credit card? If the currency collapses from something like a massive cyberattack and your virtual bank accounts are wiped out, or access is frozen and no one is sure how much money you have, then cash in hand is better than anything else. What if ammo is readily available and people just don’t have money to buy it because their bank accounts appear to be empty, and there’s no current physical log to show recent account status? Again, cash is best.

If you have a diamond and no one has cash to pay for it, what good is it? If you’re sitting on a stockpile of clean water and no one else has it, all of a sudden you’re one of the richest people in the country. But how do people pay you if there’s no money to pay you with? Are you going to accept service for payment? There are so many variables to consider.

If you’re in a situation where the problem is localized and you’re trying to leave a country where there’s financial instability, you want to have something portable. The most portable asset is probably cryptocurrency. It’s available anywhere there’s an internet connection. If you had $1 million in cash, it’d be much more difficult to transport physically than a few diamonds, but how likely are you to walk around with pockets full of diamonds? You’d have to find someone who’d buy them and then provide certificates proving their authenticity. And if you need a loaf of bread, you’re not going to chip off a sliver of diamond to buy it.

I think a lot of it comes back down to diversification and not having all of your assets in any one particular type of currency. If things are bad and you have a $10,000 diamond that you’re desperate to get rid of in exchange for cash, people are going to smell the fear on you and might only offer you $2,000. At least you know what you have with cash.

Raymond Sfeir: Historically, people move to buy gold or some fund that trades in gold. This way if prices go up and the currency is going down, they don’t lose value. They’re not buying gold itself and storing it at home, just buying shares in companies. That’s one way. Lately with what’s going on here, the gold prices went up. Many people invest in funds that trade in gold, but in most cases around the world, whenever a currency depreciates, the people of the country try to buy a foreign currency where the inflation rate is not high.

The best example is what’s happening in Venezuela lately. The bolívar depreciated a lot. Last year, some estimated the inflation rate to be 1.6 million percent. So, what did people do there? If you had the money, some invested it outside the country if they could. Many started buying dollars, euros, yen, any foreign currency that kept its value. This is mainly what people do when there’s inflation, and the currency in their country has depreciated very fast. Just to get some other currency, vendors selling stuff also tried to create prices on their goods in foreign currency. When anyone receives money in their own currency and it’s depreciating enough, they tend to get rid of it as quickly as possible.

If someone sells something in Venezuela for $10 million bolívars, they try to use that currency immediately and buy something else, something physical. It could be anything, not necessarily anything major. By doing so, the velocity of the money increases — how often the currency is used for a period of time. When people plan to get rid of the currency, money turns over quicker and the currency depreciates even faster. That’s what’s happening now. When people get any amount of bolívars, they try to get rid of it, by buying dollars or buying something else. This is basically how people behave whenever you have a high inflation rate.

As far as a cyberattack on the financial system, we’ve had cyberattacks, but they didn’t impact our economy very much. If something happened on a larger scale where people lose confidence in the currency they have, they would also have to lose confidence in other currencies as well, so it’s really disastrous in that sense. In that case, you go to physical goods. You just try to get rid of any currency you have and no longer accept it as payment for selling something, which would make it depreciate even faster. You try to hold onto physical goods. Some people may buy canned goods if they feel the situation is very dire and they’re going to run out of food. I don’t know if anyone would start thinking about buying real estate. It’s probably too late at that point.

Yes, you can buy gold. Obviously, there’s not really gold or silver coins in circulation like there were hundreds of years ago. The reason they used gold is because it was used in jewelry, so it had value to the people other than for trading goods. If they didn’t want to trade their goods, they could always use it, sell it, and get jewelry for it. When you lose confidence in the currency, you just go to physical goods if you can, or other currencies that are not depreciating.

Chris Thornberg: In the book Money Mischief by Milton Friedman, one of the things he talks about is the history of money and what money is. Once you get into the definition of what money actually is, you have a better sense of what can be money in some post-apocalyptic setting where banking systems have collapsed. In general we know that people are better off in a world where they can trade with one another. The most basic form of trade is barter — simply exchanging something you have for something they have. But barter has a fundamental limitation inasmuch as it can only work if two people both have something the other person wants. “Money” in its primal form is nothing more than a commodity that is kept on a person for the sheer reason that most, if not all, people would want it. As such, our clever trader will always have something to barter.

If you’re a caveman and some guys come along with a few new spear points and you really need one, the question is what you trade for it. It really depends on what you have on you. Because of the nature of barter, it depends on your having what the other person wants. A lot of times there could be a potential transaction, but the available inventory prevents that transaction from happening, so the next step becomes asking yourself what you can carry with you that anyone might want. In other words, what is a product? What can you keep in your pocket that you know most anyone would want? Even if they don’t want it, you can give it to someone else for something you do want. What qualifies as “money” is something that is highly desired and reasonably easy to carry around with you. This is a just a product, but that product can take on a life of its own. It starts out being something people know is an easily traded product, but rapidly turns into “money.”

Everyone always thinks of gold. Right now, people are talking about how the price of it is up in this uncertain environment we’re in, and the gold standard, and whatnot. Gold is just reasonably shiny, but very soft metal for most uses. So, it doesn’t really have a lot of true use from a global perspective, but it was desired because it has value from an ornamental perspective. People were carrying around pieces of gold because you could use it yourself or give it to someone who wanted it. One of the earliest forms of money was cowrie shells. There’s evidence of them being found far inland at the tops of mountains being carried around by people a long, long time ago.

When you ask what people should do when there’s no more money, to me, money will create itself. Societies that are cut off from the normal forms of monetary economies quickly adopt one.

In Money Mischief, Friedman described WWII prisoner camps. They didn’t have access to money, so what became the de facto currency in those camps was cigarettes.

Most everyone smoked and, even if they didn’t, they knew someone who did. It was an easily tradeable, small product that you knew you could unload somewhere. Very quickly, it took on a life of its own, and the money supply became largely driven by cigarettes and everything was priced in cigarettes.

Some of what might become the proverbial cigarettes in an economic collapse or some other disaster would depend on what the economy looks like. Things like diamonds, gold, or any metal that’s reasonably valuable will probably continue to be valuable. If things were scary enough, I could see bullets becoming a form of currency. Something might be valuable, but that’s a different conversation from what could be used as currency. Water might be valuable, but the problem is it’s too heavy. It still makes sense to stock up on those types of commodities that one will surely need, but think through anything that is reasonably dividable, because you have to make change somehow. Water is dividable, but a car isn’t. It’s got to be reasonably dividable, reasonably small, and have a reasonably wide need.

For example, let’s go back to how bullets could be a commodity. If we’re in a world where self-protection and hunting is going to become important, bullets make sense. What kind of bullets? The answer to that is common. What’s the most common bullet out there? That’s what you want because that’s going to have the broadest acceptance as a form of currency. Ask yourself what else would fit that same criteria.

Possible Causes of Economic Collapse

What do you think might cause a situation where cash is worthless or inaccessible?

CK: As far as inaccessibility from the government having less money in circulation, they can reduce that at any point. Inflation is a perception thing. As people perceive the relative strength of the economy, it drives how much someone wants for their goods. If I think there are more bills in circulation than there should be, I want to take more of those off for my product. There’s over $100 trillion in unfunded liabilities in the U.S. There’s the national debt — that’s outstanding bonds that we owe bondholders. In addition to that, there’s liabilities we’ve said we’re going to meet like social security, Medicare, government pensions, etc. I don’t think that’s a sustainable thing. I don’t think you can have a deficit like that and expect people to take your bonds in lieu of some kind of hard currency, oil, gold, or whatever they decide on. I think there’s a point at which people will say, “We’ve had enough of your paper, now we want something tangible.”

Junk silver would be a good thing to stockpile, but having been in the jewelry business for 15 years, I’d say no. Numismatics are collectible coins — avoid them at all costs. Those and jewels rely on the “greater fool” theory, sort of like baseball cards or stamps. They’re items that are collectible and have a value higher than their intrinsic value. You’re better off to just have a 1-ounce silver coin you know the value of, so you’re not hoping to find a greater fool down the road willing to pay more for it than you did. The same goes with gems. They’re great when the economy is stable, and you may be able to travel with them undetected, but that only works as long as you know there’s a seller on the other end willing to pay the same price. When the grid’s down and people want assets they can immediately transfer, I don’t think anyone is going to immediately want to pull out a diamond loupe and try to grade stones on their own. That doesn’t seem reasonable to expect.

Silver itself is very bright and distinctive. No other metal has that bright white color to it. There were some Chinese gold bars on the market a few years ago, the center of which was tungsten and the exterior was gold. That’s where people started drilling into bars or using an X-ray spectrometer, which is a very expensive device. That’s why I think junk silver and silver ingots present a better avenue for these kinds of situations because the scale at which you need to counterfeit things doesn’t lend itself to counterfeiting silver or a 1-ounce gold coin. It lends itself to counterfeiting 400-ounce gold bars, but a single ounce of gold at $1,500? I don’t think most people would think it’s worth that much effort to fake it.

Gasoline has a shelf life. I can’t see anyone attempting to barter with crude oil, but money is always immutable. There’s a reason why precious metals have been money for the last 4,000 years. No one’s really invented a better mousetrap yet, until the advent of cryptocurrency. Volatility can kill you. In a grid-down scenario, people will be beholden to whoever has the thing you’re trying to buy with your currency, whatever form that may be. The seller of the goods will derive the price. If I have to get gas after an EMP, I’m probably going to have to exchange some silver. Am I going to get the last published price for silver? Probably not, I’ll probably have to pay through the nose so the volatility in this situation is going to suck, but I believe there’s no chance people will want to take paper. They’ll want to take something they can move, which will be some other type of commodity.

RS: On an individual country basis, it’s usually the printing of currency by the central bank in a country that triggers inflation and depreciation of that currency. In Venezuela, that’s the case. In Zimbabwe, it was also the case. The government didn’t have enough money to pay workers, so they started printing money, but people noticed there was lots of cash around, and it lost value. It was the same in Germany in the 1920s. Germany was not able to pay reparations for the war to Britain and France, so they printed money and gave them depreciated currency, and they used that to buy other currencies in order to pay.

I don’t know of a situation historically where people lost confidence in all the currencies of all countries in the world and they all depreciated at once. Normally, it’s one country here or there because of a particular situation, such as Venezuela. I frankly can’t imagine a situation where all currencies of the world are going to depreciate at the same time, where people will panic and lose all of what they have when it comes to bank savings or holdings in treasury bonds.

Keeping money at home is a risky deal because of theft. You hear about people being robbed all the time, so it’s not wise to keep a large amount of cash on hand. If the currency is going to depreciate, whether you have it in the bank or under the mattress, it’s worthless anyway. Saving cash — beyond a few hundred dollars in an emergency — in my view is not wise. Investing in gold or having real estate, which is something physical you’re not going to lose, might be a better decision.

We had a really bad recession in 2008. That was the worst recession since the Great Depression. The dollar did not depreciate dramatically. We exported our depression to the rest of the world, because we are a very large economy. Our imports decreased and that hurt other economies. So, there was a recession worldwide, but it was disastrous as far as economies are concerned. We started recuperation a year or two later. The currencies didn’t really become worthless. The dollar didn’t change much in value compared to other currencies, because all economies around the world went down growth-wise.

There were some panics for particular banks because people thought that if a bank goes bankrupt, they might not get their money back. They weren’t worried about depreciation of the dollar; they were worried about not getting their money from the bank — that’s why the FDIC started insuring deposits not just up to $100,000, but up to $250,000. The percentage of people who have more than $250,000 in one account in the bank is very small. For the vast majority of people, that limit covers them adequately, and it did during the recession. That was one situation where it didn’t create a panic on currencies, it created panics on weak banks, but most people didn’t lose money because they were insured. Outside the U.S., when some smaller banks go bankrupt and don’t have the equivalent of our FDIC, then some people did lose their money — not because of the currency, but because of that banking system itself.

In Venezuela, I think many people try to get dollars and deposit them in the bank, keep them with themselves, or open foreign accounts. The rich people know how to do that. They have advisers to tell them not to keep money in bolívars. Inflation is still extremely high, but they expect it to go down because the central bank there is requiring the banks to hold more in reserves. That means they will not be able to lend as much to the public or to businesses. By lending less, that will decrease the inflation. They’re taking some action to stabilize the currency, but it hasn’t worked yet. It will be better than last year, but it’s still very bad.

In China, when Mao took over, the Chinese currency depreciated much worse than today’s Venezuela. It was equivalent to what happened in Germany and Hungary before that. The yuan became worthless. People lost everything they had, and they kept changing the yuan into new currency. They changed millions of old yuans into new ones, and it didn’t work either. At the time, the Mao government told those who were holding Chinese bonds that they weren’t going to pay them. Eventually, they paid only a few pennies per yuan.

When things like that happen and they don’t honor the debt of the people’s government, the currency becomes worthless. Those who lent money to the government lose everything that they have. This is not the first time that has happened. It’s happening in Argentina today. If the country cannot honor its debt, those who lent money will have to take what they call a “shave” — they lose a percentage and they renegotiate their loans with the government, but they end up being losers. Now the interest rate in Argentina is 60 percent. If there is something as dramatic as the Communist Revolution, the currency becomes useless and they lose all the money they’ve lent to their government.

With Brexit, when the vote was taken about three years ago, the value of the pound went way down. The pound used to be around $1.61; now it’s trading around $1.21. So, there was a huge decrease in the value of the pound. I think it’ll continue to be at a low level if Britain leaves the EU because its relationship with them will not be the same as it is right now. Most likely, they may have some kind of agreement as to tariffs and so on, but in the short term, if they’re going to have a hard Brexit, there will be tariffs between the countries. They will not have the agreements that they used to. It will be more difficult for them to sell in the EU because they will not be treated like an EU member. They will no longer have the advantages of being part of the EU and decreasing the tariffs. On the whole, they may gain a little independence when it comes to certain decisions, but their economy will be damaged. Europe will also get hurt because they’re losing a big economy — Britain is the second largest in the EU after Germany. But Britain will definitely suffer more than the EU and other countries.

SS: Even when we had the 2007 financial meltdown and banks failed, there are so many fail-safes behind it all that no one missed a beat. It wasn’t like the value of currency dropped in the United States. However, it did happen recently in Ukraine and other countries so it also depends on where you are and what the banking system consists of. The setup over there was that the current Ukrainian president was ready to take Ukraine to the Euro. Then, at the last minute, he decided not to and sided with Putin to keep the currency the same. Overnight, the exchange rate went from about 8 hryvnia to $1 to about 28 to $1. People went to their banks and had nothing left because the value of their money was gone. It didn’t matter if you had cash, because it was as useless as the bank statements. The worst thing was a lot of people knew ahead of time about this because of the corruption. Many of the private bankers in Ukraine converted to U.S. dollars before the collapse and fled the country with the money. People woke up to empty bank accounts and no way to get the money back.

The same thing could possibly happen here, but I doubt it. For example, If oil stops trading in dollars maybe our currency would take a significant hit. Most world currencies are weighted against the dollar, so it would take a massive global attack on the financial system to do it.

On Sept. 11, the markets plummeted and people thought we may never recover, but it didn’t take long for the economy to resume normalcy. The whole banking disaster was all cause and effect. To prop up the economy, Greenspan dropped the rates to near nothing. The economy started moving again, banks started lending money, people spent that money and created a bubble. When it popped, there was a massive financial crisis. Banks had been lending money to anyone with a heartbeat with very little concern about getting paid back. When the defaults started, people just walked away and left the banks holding highly deprecated real estate with no buyers and it just kept perpetuating from there. Default after default and billions vanished overnight. However, fail-safes kicked in, the government bail-outs propped up the banks and over time, all is well again.

If you own stock, it’s not just on paper. It’s registered in multiple ways. With a bank account, same thing. You have your records, and they have theirs. If something were to disrupt that entire record-keeping system, you wouldn’t have any proof of what you had yesterday. That would be a problem. It could cause some panic, but there’s so many redundancies that I imagine it would be a very short-term situation. One system might be disrupted, but records are kept in multiple locations and it would only be a matter of time before the system and records are restored. For a few days, you might be a mess, but I think it would be restored fairly quickly. In the short term, cash would be the best option.

When I advise people on their savings, I tell them to keep at least three months’ worth of expenses liquid in an account that can be easily accessed. Think of it like retirement strategy. Your assets should be layered so you have various pots that can be liquidated as needed. Cash can be the most conservative and then banks accounts, brokerage accounts, IRA’s, 401(k)’s, real estate, etc. If things become unstable, and you have a diverse pool of assets, you have options on where to get liquidity. It’s easier to remain financially stable. If things get really bad and you have three months’ worth of cash in a safe or buried in your backyard that you can get to quickly, that’s going to help. Other assets like gold or diamonds can be converted to cash, but it will take more time. You should have other commodities that you can rely on. Maybe food, water, medicine, firearms, or maybe a little bit of everything just to keep you going.

CT: Worthless and inaccessible are two different concepts. Inaccessibility would increase the value at some level. Imagine the banking system collapsed, then currency would fall back into the liquid cash that people have available. On that basis, one could argue that even having stacks of ones and fives around would be a form of currency. Having liquid cash in hand, if people still believe in the dollar, would be a reasonable form of currency to keep around. That’s different than if the currency becomes worthless. It becomes worthless for one reason — people don’t think it has any inherent value.

When you go back to how currencies evolved, gold was desired, it’s easily dividable, it’s small relative to its value, and it’s broadly accepted. Gold then starts to take on a life of its own. Gold is no longer just a commodity that people trade frequently; now all by itself it’s an asset. That is to say, you might hang onto cigarettes or gold because you know it’s a good way of accumulating wealth. Now it’s turned into something bigger than the product itself. The true value of gold from a jewelry or an industrial perspective is significantly smaller than the actual price of gold because people have this inherent monetary vision of what gold is. If people didn’t think of gold as a form of safe haven currency, the price would be much lower than it is today.

After it’s taken on a life of its own, you go into a fiat currency, which is where you simply replace the gold with pieces of paper. The funny thing about pieces of paper is, in the context of gold or a cigarette, you can look at it and see if there’s some inherent value to this product even though you’re using it as money. There is no inherent value to a dollar outside the fact that someone else will take the dollar. So now you’ve made this complete transformation from a product that has no monetary value to money that has no product value. There’s this interesting transmission in how things go about shifting in a particular context. Currency is only worthless when people won’t take it anymore. They won’t take it because either they’re not culturally familiar with it or they think it won’t buy anything.

One way you could destroy currency is if government has the inability to collect taxes through normal means and decides to fund their efforts through printing money. This is the classic walk to hyperinflation. When hyperinflation hits, that is to say the price of goods goes through the roof, that’s another way of saying that people don’t value this paper currency anymore. In a sense, keeping ones and fives is a great idea if the bank system collapses, but it’s a terrible idea if the government should go into a hyperinflationary spiral of money printing and spending.

I don’t think we should be on the gold standard. Fiat currency works great as long as the central bank has the incentive not to print money and create hyperinflation. We have an independent federal reserve because politicians do have the incentive to create inflation because in the short run, a surge of money can get the economy heated up which can be good to get reelected. Since we know now that democrats and republicans both seem convinced that you can continue to deficit spend forever, you need someone else to have control over the money supply because that’s exactly the kind of behavior that will create hyperinflation.

We have an independent federal reserve because they’re largely in charge of the money supply, which is another way of saying they’re largely in charge of maintaining the confidence of the general public in those little green pieces of paper. Pushing up the price of gold past its true value on the basis that it’s money is inherently detrimental. We’d rather have gold prices be where gold prices should be from a consumptive standpoint, not creating this excessive value on the basis of potential monetization. Think of all those poor tobacco smokers in that POW camp. Now you have to feed your nicotine habit, and the only way you can do that is by burning your money. A fiat currency is fine as long as you can trust the people who are in charge of maintaining the currency.

Stockpiling precious stones or metals is fine for the reasons I just said. They’re generally desirable, tradable, and reasonably dividable. It could turn into a currency. I have faith in the banking system though. I think it’s well-managed. I don’t have worries about hyperinflation. I believe in the federal reserve, so I don’t have any problem putting money in the banking system. If we did start to see a turn where the federal reserve is taken over by the federal government, or if I saw elements within the federal government wanting to create hyperinflation like in Zimbabwe, then I might change my mind on the need to stockpile money at home. But in its current form, I’m reasonably comfortable with it.

In order to see a huge catastrophe coming on a global scale, you have to be looking at levels of debt, rates of inflation, money supply, etc. A lot of it is just paying attention to the monetary system. I laugh when I hear people say that the federal reserve is a black box. It’s not a black box. You can go on their website and download all their financials to know exactly what’s going on. They’re probably one of the most transparent operations in government.

There are guys who want to claim end of the world all the time and predict recessions every 12 months, but a lot of them may be incentivized to say that. They all want to be the guy who predicted the recession. If you want to get the media to give you free publicity, you kind of have to go out and make crazy calls. Even people who don’t understand the finer points of financial nuance could read a book like Money Mischief and understand it easily. There are plenty of books that talk about how monetary systems and central banks work. There are ways to become educated and, once you’re at that point, then I think you can understand how to look at the data a little more. You don’t need a PhD to understand it.

I spend an inordinate amount of time as head of Beacon Economics pointing out the obvious. Recessions are anomalies. Growth is default. Every recession has a cause that’s a large, negative shock to the system. When I say I don’t think there’s going to be another recession anytime soon, it’s because I don’t see any potential shock to the system large enough to create a recession type scenario. You’re constantly looking for the tip of the iceberg that’d sink the Titanic. If any forecaster tells you they know when a recession is coming, they’re lying.

More in Fiscal Security, Survival, and Preparation

- The Does and Don’ts When Traveling with Money.

- A Surprising Comeback: Great Depression Era Tactics for Saving Money.

- Keeping Your Finances Afloat through Covid.

Related Posts

The post Surviving an Economic Collapse appeared first on RECOIL OFFGRID.

The Viral Truth

The United States has seen its share of tragedy in the 21st century and since then, the nation that we call “home” has changed dramatically. Public health officials have been cautioning Americans since 2001 that a horrific pandemic has been lurking at our doorsteps to infect every world citizen. In fact, public health agencies around the world gave dire warnings about the horrors of H1N1, Ebola, SARS, and MERS, all of which were deadly in their own right, but failed to cause the level of death purported by the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC). The fact of the matter is world citizens lucked out with those disease outbreaks. But that was then…

Once again, the landscape of our world has witnessed historical changes unseen since the 1918 Spanish Flu pandemic, which was responsible for anywhere between 50- to 100-million deaths. Ironically, even though the Covid-19 pandemic is different than the Spanish Influenza, one does not have to dig deep to understand that many of the societal struggles we face with today’s pandemic are very similar to those witnessed during the 1918 outbreak. Modern society is larger, faster, and more prone to accepting conflicting information today than it ever has in the history of mankind. Since the inception of social and mainstream media, most world-residents remain in a constant state of confusion as to what constitutes fact over fiction.

To help alleviate some of that confusion, RECOIL OFFGRID Magazine has brought together a few experts to examine the lines between fact and fiction surrounding the Covid-19 pandemic. Dr. Amesh Adalja is an expert in infectious diseases and emergency medicine from the Johns Hopkins Center for Health Security. He’s joined by Dr. Eric Dietz, director of the Purdue University Military Research Institute and Jeff Schlegelmilch, director of the National Center for Domestic Preparedness at Columbia University. Finally, Dr. Tim Frazier, faculty director of the Emergency Disaster Management program at Georgetown University, will combine his extensive field expertise to aid in the article’s search for answers with Dr. Robert Quigley, senior vice president and regional medical director of International SOS. All panelists will share their in-depth knowledge to help answer the question we are all asking: Is the truth about Covid-19 still out there?

“It’s always a good thing to re-evaluate where we’re going, and we should demand that of our elected officials and health professionals who are charged to keep us safe.”

— Eric Dietz

About Our Panelists

AHMESH ADALJA

AHMESH ADALJA

Dr. Adalja is a Senior Scholar at the Johns Hopkins University Center for Health Security. His work is focused on emerging infectious disease, pandemic preparedness, and biosecurity. Dr. Adalja has served on U.S. government panels tasked with developing guidelines for the treatment of plague, botulism, and anthrax in mass casualty settings and for the system of care for infectious disease emergencies.

ERIC DIETZ

ERIC DIETZ

Dr. Dietz’s research interests include optimization of emergency response, homeland security and defense, energy security, and engaging veterans in higher education. As a director of the Purdue Military Research Institute, Dr. Dietz organizes faculty to involve current and former military in Purdue research with focus on defense and security projects to increase Purdue’s involvement in national defense.

TIM FRAZIER

TIM FRAZIER

Dr. Tim G Frazier is a full professor and the faculty director of the Emergency and Disaster Management program at Georgetown University. Dr. Frazier’s research focuses on developing science that serves to impact decision-making in local communities through stakeholder engagement.

ROBERT QUIGLEY

ROBERT QUIGLEY

Robert L. Quigley, M.D., D.Phil., Professor of Surgery, Senior Vice President and Global Medical Director, Corporate Health Solutions, International SOS Assistance & MedAire, Americas Region, is responsible for leading the delivery of high-quality medical assistance, healthcare management and medical transportation services. He’s the executive chairman of the International Corporate Health Leadership Council as well as the chairman of the Council for U.S. and Canadian Quality Healthcare Abroad.

RECOIL OFFGRID: What statistics are used to gauge the severity of a disease outbreak?

Amesh Adalja: There are a lot of statistics out there, and it depends on what your purpose is when looking at statistics and finding what is useful to you. When examining the spread of disease, the number of cases is one aspect to look at, but that has to be adjusted for how much testing is going on. There are places that are increasing and decreasing their levels of testing, so you have to look is the percent of positivity. In other words, how hard is it to find a new case, which is an important number to look at because it’s an indicator of what the community spread is. It’s important to keep in mind that patient deaths are a lagging indicator, so you’ll likely not see an immediate rise in deaths if you see an outbreak spiraling out of control. That’s also another marker to look at for the severity of the virus.

Eric Dietz: One thing to keep in mind is that all statistics are very different. The spread rate might be very high, but we may not care as much if the disease is not lethal. If the lethality is high, however, we’re going to have a significant concern. There are a variety of factors involved in determining statistics such as how fast it spreads, its lethality, and severity of the symptoms. Each one has its own quirks, especially as they relate to Covid-19 and new data emerges.

Tim Frazier: What’s critical at this point are looking at infection rates, the number of new cases from a day-to-day perspective to track the spread, and to track mitigation measures.

Robert Quigley: Metrics such as number of deaths, number of cases, rate of new cases all can certainly be valuable in gauging the severity of COVID-19 in any one jurisdiction. However, they are far from complete, and methodologies in interpretation can vary from region to region. The denominator (i.e. the total number of cases) can only be determined by testing. That said, the combination of limited testing resources and asymptomatic vectors (unknown to public health statisticians) makes calculation of the denominator next to impossible, so at any one time we only see a fraction of the actual cases, which would not permit accurate reporting on the rate of new cases.

Are Masks Worth the Work?

The reality of the pandemic is that a lot is not fully known about the exact benefit of potential safety measures. Ventilation, air filtration, masks, and social distancing all have a positive effect in limiting the spread of the virus. There is a lot of modeling, retrospectively, to understand the value of each of these measures. When you’re dealing with an infectious disease, you are dealing with a variety of factors such as transmission through shedding, through vapor droplets, and so on. It’s important to understand that wearing a mask is not to protect me from you, but it’s worn to protect you from me. The precise value of masks is not known, but they are an important tool in the toolbox to lessoning the spread of the virus.

What source numbers are used to compile patient data for Covid-19?

AA: Most data is being collected by local and state health departments, and they are providing essential situational awareness. The data is vital to hospitals when they decide upon whether various elective procedures can fit within their capabilities, all of which are stressed due to the pandemic. It’s also important to note that all data is not iron-clad. There will be fluctuations in the data that are contingent upon several factors, which is normal in this field. Collected data, however, still gives an over-all view of the viral activity within our communities.

ED: I also look at peer-reviewed journals where other scientists have examined many issues surrounding Covid-19, develop their own analytical data, and then share that data with the community.

RQ: The public health authorities, such as the CDC and Johns Hopkins, responsible for collecting/interpreting/sharing data have COVID-19 dashboards, situation reports, and daily data tables accessible on their websites. Their data sources include all of these as well as regional ICU admissions, recovered patient numbers, local/national lab results, as well as data developed from morgues and funeral homes.

TF: The number of new cases is reported by medical facilities to local health departments, so health departments have the cases needed to compile a list of statistics to report to State Health Departments. For example, if someone has it and they don’t go to the hospital, then it won’t get reported. In all likelihood, the cases of Covid-19 in the Nation are under-reported and surpass the data we actually have on record.

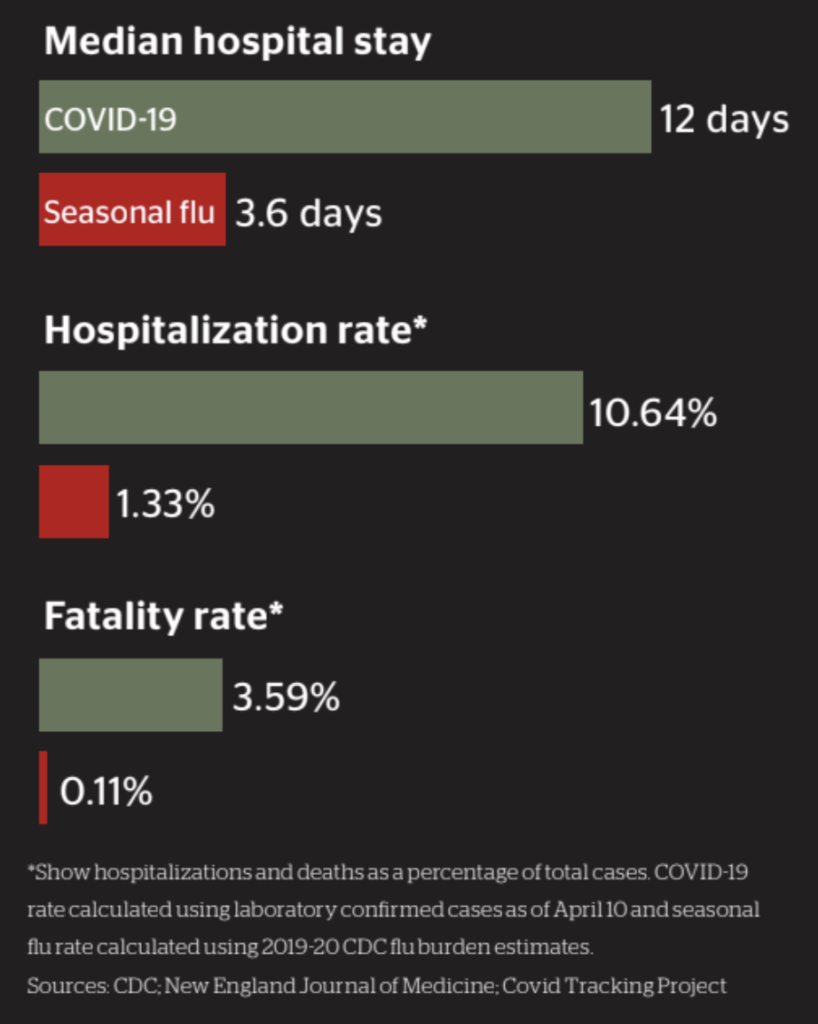

COVID-19 vs. Seasonal Influenza

The key two differences between COVID-19 and influenza are the transmissibility of COVID-19, as well as its fatality rate. We’ve seen other Coronaviruses such as MERS, which has a high fatality rate but is not very transmissible. Flu is highly transmissible but does not have the fatality rate that COVID-19 exhibits. The ability to spread easily and kill a higher proportion of people are what separates COVID-19 from other common viruses and make it a deadly pandemic today.

What, if any, mechanisms are in place to prevent false or inaccurate reporting?

AA: Health departments should try to remove duplicates if someone had more than one test, or different types of tests, that came back positive. That should only be counted as one positive case and not two. We see this in cases where someone will be tested for the virus to be discharged from a nursing home, and then tested again to see if they are cleared to move back into the same institution. When you look at deaths, there is an adjudication process in which health departments will see if a death was caused by Covid-19 or was it incidental to Covid.

ED: The duplication of reporting is something that many of us are frustrated with right now. There does not seem to be a quality control part of the program that really understands how many in the nation are really sick. All that we know now is the number of positive cases that are in a geographic location, but we also know that same positive individual may have been tested several times. Each positive person might be contributing an amount of positive tests back into the pool of data which allows some to claim that there is much more disease than there might be. We need to get a handle on quality control before we progress with this pandemic or prepare for the next one that might put us in a more difficult position.

“There are a lot of slanted pieces of information out there, as well as “arm-chair epidemiologists” who are attempting to re-define data and reconceive notions.”

— Amesh Adalja

RQ: Laboratories, by no fault of their own, can only report results as they are generated. The false positive/negative rates are simply a reflection of the efficacy of their tools. Unfortunately, the testing tools are not standardized, so different labs will be expected to have different accuracy rates in reporting. Whether testing for antigen (SARS-Cov-2) or antibody (IgG), no test is 100% accurate. Tests need to be performed on a large number of samples and validated multiple times in order to get an estimate on specificity/sensitivity. Finally, because this virus is novel, more research is still required in order to define quantitative thresholds for accuracy in the short and long term.

TF: I would say that there is a level of inaccuracy on reporting and under-reporting. There is probably a range of error that we don’t know very well. There are deaths that are getting reported as Covid-related that aren’t Covid-related. I think that the challenge is to understand what the error margin is and being okay with a certain percentage of error margin in the reporting and under-reporting of cases.

Pandemic Battle: Covid-19 versus 1918 Spanish Flu

There are echoes to the politics of 1918, such as the opposition to wearing masks. There are also stories of communities coming together to figure out how to beat both diseases. There is also a longer shelf life to the political science than there is to the health science when exploring the social aspects of both pandemics. However, during the 1918 outbreak, there were not nearly as many advances in the health industry, and it was based on old-school epidemiology which hasn’t changed much today.

It’s also worth mentioning that even in absence of game-changing therapeutics, there’ve been improvements in how we treat people with Covid-19. The transfer of information is tremendously quicker than it was in 1918, which makes data and peer-review dispersal among healthcare organizations that much quicker. The research and response measures are moving faster than they feel. Pandemics, much like the 1918 Spanish Flu, just take a long time to get through.

How does timing come into play when we study data? How soon is too soon for data to be considered valid?

AA: You must remember that when you see a daily case count from a county health department, that those are not the cases that occurred the day before. There are often going to be lag times in reporting, so you’re never seeing a snapshot of cases that occurred during that particular day. Usually those numbers reflect positive-test cases from a week prior. It’s not a highly precise number, and that’s not an attempt to fault anyone. It only reflects the nature of the data reporting process, especially during a novel virus outbreak. The data is collected not for data’s sake, but to gain a sense of the issue so we can institute the public health actions needed on an individual and community-wide basis.

ED: The issue we have surrounds the type of data we want and how do we want it characterized? We must figure out how we’re going to analyze data before we ever collect it. This is one of those cases in which the data methodology needs to be carefully thought through. It’s an ongoing problem that plagues every disaster that we’re faced in America, and we’re going to have to ask ourselves how we’ll distribute an eventual vaccine based on the data we’re receiving during this pandemic.

TF: Within a matter of days, the data finds where it needs to go and probably anything more than a week old is out-of-date at this point.

RQ: Timing is critical when interpreting scientific data. For example, testing infected individuals too early can produce false negative results. Reviewing epidemiologic and demographic data when the denominator is too low could produce an exaggerated “R naught” (viral reproduction rate) as well as an exaggerated mortality rate. The question isn’t “how soon is too soon,” but rather “when do we have a statistically significant sample size from which to draw a conclusion?”

Is it Time to Ease Up?

More than half of Americans carry chronic conditions and we have an aging population that carry more than one chronic condition. Anytime those are present, you are at a higher risk for exacerbating those conditions with illness. Even if that was a smaller part of the population, we’re still seeing huge numbers of deaths that don’t need to happen. As a civil society, we have a responsibility to protect each other. If you go out to overly crowded locations, you’re potentially bringing the virus home to someone and introducing it to another environment. One of the reasons that the playbook from the SARS outbreak in 2003 isn’t working is because the virus is spreading before people are symptomatic or don’t show symptoms at all. We may not be sick but are shedding the virus, and the elderly person behind us in the grocery store could die from it. There are a lot of people out there who say that this pandemic is not so bad, but all you have to do is look to the refrigerated trucks to store dead bodies in when the morgues in New York City were overwhelmed with bodies.

What are some ways that the average person can distinguish accurate facts from misleading facts that are slanted one way or another?

AA: For the average person, it’s very hard to determine what is valid and not valid. People should stick to websites that have been validated to receive their information, such as the CDC or state health department, with the caveat knowing that those numbers will fluctuate depending on the type of data collected and when that data was collected. Regardless, it will be very hard for the general public or someone who does not have a background in this field to distinguish the accuracy of the information out there. There are a lot of slanted pieces of information out there, as well as “armchair epidemiologists” who are attempting to redefine data and reconceive notions.

ED: It’s a frustration that all of us have right now with the mainstream media who practice an overly politicized system of reporting in our nation. I think that any institution that’s relaying contradictory information to the public has a duty to let the public know, with a little more clarity, as to why we’re taking some of these measures during the pandemic. Since there are numerous information sources available to the public, it’s important for us to find those sources that are cited and verified so we can gather information that is trustworthy and consistent with our values. We also need to reevaluate our actions and that we’re doing things that are effective, and not because someone is trying to socially or politically pressure us into doing something that makes doesn’t make sense.

RQ: Scientific reporting and politics are incongruent. The reporting of clinical or scientific data should always be done in an apolitical forum to avoid any misrepresentation of the facts. Unfortunately, many search engines used today are not apolitical. The closest source of untarnished data may be the actual peer-reviewed literature.

TF: I would hate to say that this has been over-sensationalized, but I may steer clear from publications such as blogs and newspapers. The most accurate sources of information will be available from the CDC, which is very good at what they do, and they are going to give you the most reliable information that you will need. Local health departments will also give information that is specific to that particular county, so someone looking to track the spread of Covid-19 would do better to follow the information from those sources.

The Long-term Effects of Covid-19 Mandates

Right now, we have a generation with key developmental milestones. Even if there is a vaccine, it’s not going to be effective enough to quickly undo the precautions set in place right now. There is also some long-term trauma that Americans have faced, be that a loss of a job, isolation, emotional and physical grief that exacerbates mental health issues, and delays in developmental milestones for children that could follow them their entire lives. These are all things that we don’t fully understand the long-term impacts yet.

Even with the Covid-19 stimulus bills, we are racking up an enormous amount of National debt while climate change still occurs, and natural disasters are increasing. Wherever the pandemic goes, the trajectory of natural disasters is only going to increase, and the resources that we need to mitigate disaster in vulnerable areas is being depleted right now. All of these put a lot of pressure on the future.

There is also a silver lining here if we look for it. We’re better at remote work than we ever have been before because everyone is getting better at technology. We have to be. In that way, this pandemic is really accelerating aspects of our civil society and economy. This trajectory has been established, and I don’t think that we are going to go back to the way it was before Innovation is always hard to predict but is prevalent during times of necessity when solutions are needed. Covid-19 is no exception to that.

Are patients who have died for reasons other than Covid-19 still tested for Covid-19, and if so, why?

AA: There is some misinformation of what happens when you fill out a death certificate. A Covid-19 death, for example, can be complicated by things like diabetes or hypertension, so all three will appear as a cause of death on the death certificate. Medical practitioners are just trying to give as much a comprehensive picture of the cause of death as possible, so we list all co-morbidities on death certificates to gain a realistic idea of how someone died. It’s a frustrating conversation that we’ve been having with others because it detracts from the real work that should be done. Valuable time and resources are being spent to focus on conspiracy theories that are completely false. I would argue that when someone makes these types of claims, they should examine the excess deaths in cities that have been hit hard and compare it to one year ago. After comparing that data, it becomes very hard to argue that Covid-19 is not a deadly disease.

ED: We’ve gotten a lot better in understanding how this disease works, but there are still instances in which Covid-19 is attributed to deaths that shouldn’t be. I would understand testing for deaths in a nursing home to better understand how Covid-19 entered the facility. Nursing homes are a very dangerous place to allow the virus to enter, which are also prone to influenza-related deaths. As we go into flu season, I can see a greater need for testing to distinguish Covid-related deaths from flu-related deaths, but there still needs to be some checks and balances to ensure that deaths un-related to Covid-19 are not attributed to the pandemic.

RQ: This could happen for multiple reasons. There are times when pre-morbid testing results revealed a false negative. Also, antibody data can provide more demographic data for the public health authorities used for activities such as contact tracing. There have also been instances when the death occurred at home, and the deceased have not been tested in any healthcare facility

TF: There could be some who are tested for fear of that patient’s relation to a population mass for the sake of contract tracing, but I feel that those cases may be on a more limited scale than those who were suspected to die from Covid-19.

Can we contract Covid-19 twice?

The short answer is that we don’t know. The long answer is mixed with a little bit of speculation and a little bit of information. There have been tests on tens of thousands of those who have recovered from Covid-19 who are not showing any signs of resurgence, so that is very reassuring. The bigger question is how long will the immunity to Covid-19 last? Covid may be like influenza, which replicates in a very messy way, so it tends to mutate, or “drift.” Therefore, we need a seasonal flu vaccine every year. So the question will be if people infected with Covid-19 will have a wavering immunity in which the virus weakens and they can get sick with it again, or will it shift so that they can get infected with a natural mutation of the virus? No one yet knows the answer to that, but the medical assumption is that even with a vaccine, people will still need a yearly booster shot.

Where do we go from here?

AA: We have normally lived in a world where we didn’t have to think about infectious diseases, but now we’re going to have to start looking at life a bit differently when we walk out of the door. Every activity that we do is going to have some sense of risk, whether that be contracting the virus or spreading it to someone else. It doesn’t mean that we stay at home forever, but rather be mindful of our activities and taking simple measures of protection. It will take some adjustment, but we have the tools to live safely and now it’s time to exercise those tools.

RQ: Getting beyond the pandemic will require herd immunity either from an effective vaccine or infection of the global community resulting in an R-naught value less than 1. In the meantime, mitigation efforts will require compliance by all, which include social distancing, mask wearing, and universal precautions such as proper handwashing.

TF: What we see in our field today is that everyone is their own emergency manager. They take pieces of information from a variety of sources, and they assemble that information to make their own decision. This makes it challenging because we are not always getting the most accurate information, and we don’t weigh the information from those sources. There is a lack of understanding of how this disease works, and simple things like washing your hands, not touching your face, staying away from crowds, and wearing a mask would really mitigate the spread of this disease.

ED: This is great time to remind everyone to thoroughly wash their hands and stay home if they’re sick. There is so much that we can do on a common daily basis that would turn out better if we just simply did those things. Our Nation is designed by intention to be safe and free, but our freedom is part of our safety. We’re free to get away from things that we don’t feel safe with, and we don’t want the government to tell us to certain things. At the same time, we must be able to make some of these decisions for ourselves. It’s always a good thing to reevaluate where we’re going, and we should demand that of our elected officials and health professionals who are charged to keep us safe. Our safety should not be something that we sacrifice for our freedom. Those two must go hand-in-hand.

JEFF SCHLEGELMILCH

Jeff Schlegelmilch is a research scholar and the director of the National Center for Disaster Preparedness at Columbia University’s Earth Institute. His areas of expertise include public health preparedness, community resilience and the integration of private and public sector capabilities, and has recently published his book, Rethinking Readiness: A Brief Guide to Twenty-First-Century Megadisasters.

Fearing the Unknown

There is a Chinese proverb which states that “nothing is to be feared, only understood.” Modern medicine has advanced rapidly in the past one hundred years and is on the brink of medical breakthroughs that teeter on the edge of miraculous. Diseases, however, continue to strike fear into our hearts as we struggle to understand them. History has proven that societal and political landscapes have been altered by disease outbreaks, and we are reminded of our humanity by the historical scars they leave behind, granting us lessons that we struggle to remember.

“What we see in our field today is that everyone is their own emergency manager. They take pieces of information from a variety of sources, and they assemble that information to make their own decision.”

— Tim Frazier

The Covid-19 pandemic will go down in history not only for its impact on our health and well-being, but maybe more so for its revelation of the deficiencies in our societal arenas. No individual’s health should be fodder for political gain, nor mixed within the spectrum of confusion sowed by those seeking gain from disaster. The health of the Nation does not play well as a social chess piece, but should be held in the highest of esteem as we navigate through the both the physical and civil treacheries of the Covid-19 pandemic. The fog of war created by the pandemic underscores that fear of the disease should be balanced by a healthy understanding of the threads that hold our great nation together…our humanity.

About the Author

MARK LINDERMAN – MSM, CEM, CEDP, CCPH

Mark Linderman is a Certified Emergency Manager (CEM) and 20-year veteran of public health. He instructs disaster preparedness courses for seven universities, including Indiana University’s Fairbanks School of Public Health and teaches Crisis and Emergency Risk Communication courses for the Centers for Disease Control and Prevention. Mark is considered a subject matter expert in the field of disaster-based communication and is a widely received public speaker and advocate for disaster preparedness. He channels his passion through his own blogsite, Disaster Initiatives, where he regularly interviews world-renowned survivalists, authors, academics, and government officials.

More on Survival and Health

- Color Coding for better Survival Nutrition.

- Move to Improve.

- The Secluded Strength Program.

Related Posts

The post The Viral Truth appeared first on RECOIL OFFGRID.

Americans Are Figuring Out What Democracy Really Is: Only 16% Think It “Works”

Americans are finally figuring out what democracy is: mob rule. No one can vote away your property or rights, and yet, that’s exactly what the ruling class does using “democracy” as a cover for their crimes against humanity.

Just a small fraction of Americans believe democracy is working very well, though most agree that a democratically elected government is essential to US society, a new poll has shown. Unfortunately, most see things getting worse, according to a report by RT.

People are starting to realize that they were born into a slave state and are constantly being brainwashed into accepting it as their reality. But a few truths are coming to light: voting is your consent to be governed (ruled and enslaved), government is slavery, democracy is mob rule, and no one has the right to rule over another regardless of how many vote to enslave that person. It’s nice to see people’s eyes opening to this.

The worst part, however, is that nearly two-thirds of Americans believe the level of division in the United States will either remain constant or even grow over the next five years. Once we realize we don’t have the right to remove others’ rights, that will improve as people start working together instead of against those with which they disagree. Once we get beyond the desire to violently dominate and rule over others whether by ballot box (democracy) or otherwise, the division has nothing to do but fall away.

The good news is that people are awakening to these truths that have been hidden intentionally so the rulers can maintain power for centuries.

After Brainwashing People For Decades, MSM and Governments Are Losing Control of People

Trust in most institutions has been going steadily downward in the US and other Western nations, according to PR company Edelman’s ‘trust barometer’, which measures the phenomenon. In 2021, the media received record-low ratings from Edelman, but Congress was viewed even less favorably. Indeed, the only thing worse than being a member of Congress, according to their polling, was being a journalist, according to RT.

As the trust in the system erodes, people will begin to voluntarily work together to avoid their slavery to the government. When people come together, anything is possible, which is why rulers never unite the public; they will only divide.

The post Americans Are Figuring Out What Democracy Really Is: Only 16% Think It “Works” first appeared on SHTF Plan – When It Hits The Fan, Don’t Say We Didn’t Warn You.

AHMESH ADALJA

AHMESH ADALJA ERIC DIETZ

ERIC DIETZ TIM FRAZIER

TIM FRAZIER ROBERT QUIGLEY

ROBERT QUIGLEY