Guest post by Bob Bishop

How BLM’s leadership concealed millions in diverted funds.

The Black Lives Matter Global Network Foundation (BLMGNF) just released its 2021 990 tax return, the first public financial disclosure since its founding in 2014. The Daily Mail’s deep dive into the return documented related party transactions (friends and family plans) and waste, fraud, and abuse orchestrated by Marxist trained leader Patrisse Cullors.

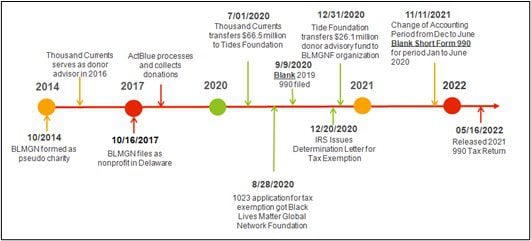

This article provides a supplemental analysis that traces the BLMGNF’s organizational life cycle. It includes two other crucial unpublished IRS tax returns, revealing huge reporting gaps and substantial unaccounted funds.

TRENDING: BIDEN’S AMERICA: Mother Caught Hoarding Baby Formula to Feed Her Infants (VIDEO)

BLMGNF Organizational Lifecycle

BLMGNF began as a pseudo nonprofit in late 2014. In 2016, Thousand Currents nonprofit became a donor advisory sponsor for BLMGNF. Fiscal sponsorships funnel money through a “conduit arrangement” from a nonprofit sponsor to a pseudo organization or a group of individuals to legally skirt the IRS tax code. Donors receive a tax deduction receipt from the fiscal sponsor. Often, the arrangements lack oversight leaving them highly susceptible to misuse and fraud, and they conceal the beneficiaries. The IRS does not require fiscal sponsors to disclose their conduit arrangements, donations, donors, or expenses in their 990 tax returns.

BLMGNF used ActBlue to process and remit public donations (BLM indulgences) to Thousand Currents. For those unfamiliar with ActBlue, it facilitates Democrats, progressive groups, and far left-leaning nonprofits fundraising using ActBlue’s fundraising platform. Corporations’ donations (BLM tribute) and far-left Foundation grants were made directly to Thousand Currents.

We first reported on this in June of 2020 during the BLM riots that summer.

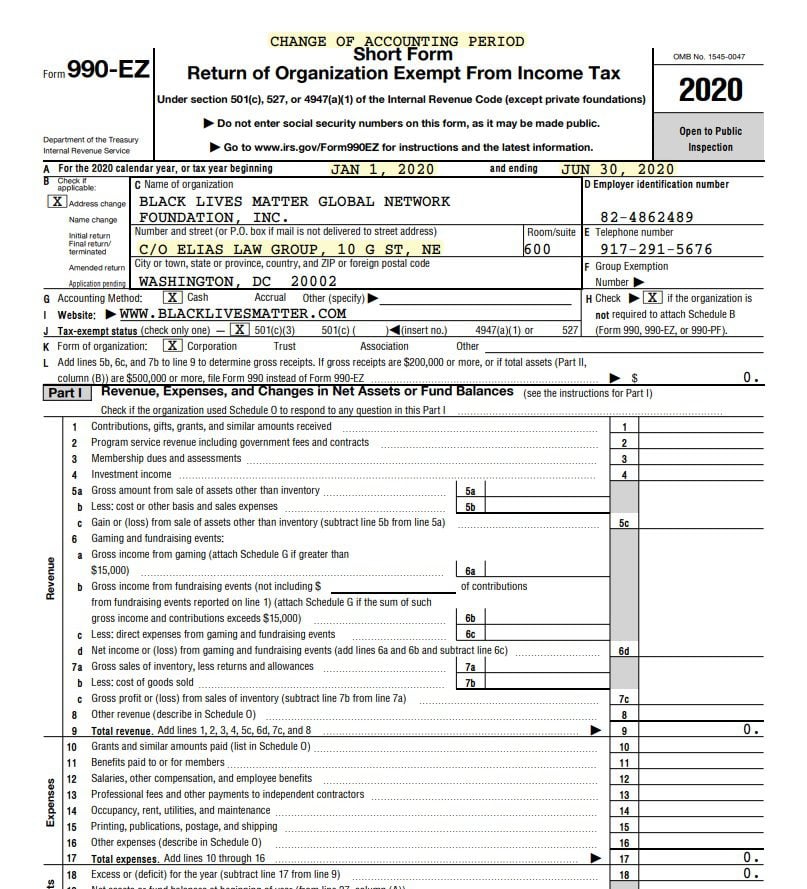

In August 2020, BLMGNF filed a tax exemption application, which was approved by the IRS in December. BLMGNF also filed a short form 990-EZ tax return (initial with application pending) for the 2019 calendar year. The blank return implies BLMGNF hadn’t received any donations and paid expenses. An extremely deceptive filing since donor sponsor Thousand Currents’ June 2019 audited financial statements disclosed it held $3.4 million in donations while paying out $1.8 million in expenses. The Thousand Currents 2019 990 return discloses Kailee Scales was paid $186K as BLMGNF Managing Director.

The Vice-Chair of the Thousand Currents’ Board of Directors was Susan Rosenberg, a convicted domestic terrorist. She was a member of the Weather Underground and Bill Ayers associate. Due to heavy and adverse publicity disclosing her leadership role in Thousand Currents and possible involvement with the BLM movement, the donor advisory was unceremoniously transferred to the ultra-left Tides Foundation non-profit on July 1, 2020. The assignment and transfer of assets (linked here) were recorded in the California Charity Registry but later surreptitiously scrubbed by the state.

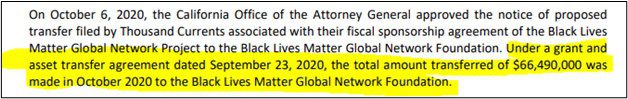

According to Thousand Currents June 2020 audited financial statements, it transferred $66.5 million to BLMGNF. Below is the Thousand Currents financial statements’ footnote omitting disclosure of the fund transfer to the Tide Foundation. Tide continued to collect substantial BLMGNF donations during the George Floyd summer protests during the next six months.

On November 11, 2021, BLMGNF filed another blank 990-EZ for a shortened period of January through June 2020. The filing also changed the accounting period from a calendar year to an annual fiscal period ending in June, a device to delay disclosures and conceal the $66.5 million held by Thousand Currents.

The tax return address is in the care of Marc Elias’s law firm. Marc Elias is a central character and possible criminal suspect in the Fusion GPS seditious scandal that created the false and seditious Trump-Russian collusion.

The latest 990 tax return for June 2021 fails to disclose the Tide Foundation serves as donor advisory or the amount of custodial funds transferred to BLMGNF. BLMGNF website disclosed (exhibit below) that the Tides Foundation holds $26.1 million in custodial funds marooned outside the nonprofit.

The funds are substantially lower than the $66.5 million transferred by Thousand Currents to Tide. The material omission of the custodial funds still held by Tide requires the BLMGNF to file an amended IRS return and disclosure of Tide’s donor advisor services.

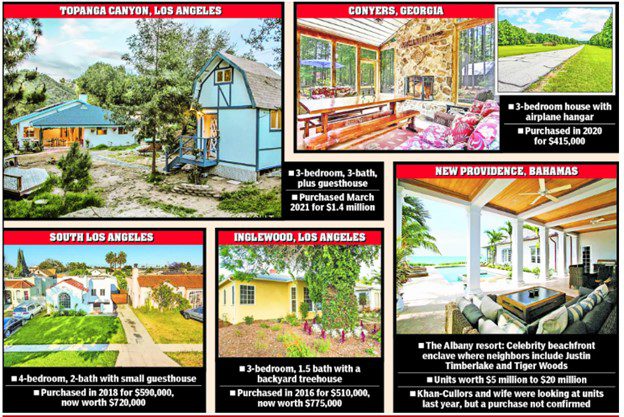

Filing two blank 990 tax returns while undisclosed donor advisors collected tens of millions in donations is deliberate obfuscation. It conceals the irregularities to avoid IRS tax reporting. For example, Cullors used advisory funds for a buying spree of luxury homes during this period, demonstrating the donor advisors failed to provide oversight.

Source: New York Post

The following timeline maps BLMGNF organizational metamorphosis.

Are Federal Agencies BLM Co-Conspirators?

Various states have revoked BLMGNF’s charitable registrations and are investigating fraud, waste, and abuse of charity funds. However, there is no indication the Department of Justice, FBI, or IRS is investigating or has an interest in BLM charity frauds. To quote George Orwell’s allegorical novel ‘Animal Farm’ “All animals are equal, but some animals are more equal than others”.

Bob Bishop is a retired corporate CPA